A combination of

- European digitals with expiries being equal to the auto call dates

- Up and Out (Auto call Barrier) and down and in Put

These structures are generally traded when the markets aren’t very bullish and not at all bearish.

Consider a case where autocall trigger is at 100%, DIP barrier at 50% and with snowballing coupons 20%, 40% and 60%.

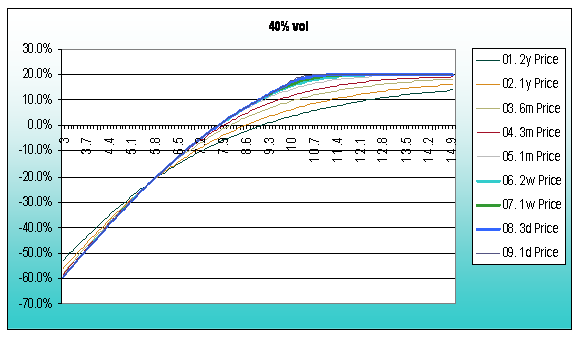

Price:

Price v/s spot

When hedging DIP delta, be careful near the DIP barrier. Don’t blindly hedge and sit on a huge pile of shares near the barrier at market close, because if the market shots down on the next day and triggers the DIP barrier, you are killed because you have to sell the shares at low prices.

Vega

Vega v/s spot

So, it’s the put that contributes to all the Vega. At higher spots and closer times to maturity, the vega sharply goes to zero as the structure has high probability of autocalling. When spot goes up, the probability of autocalling increases as a result long term vega has to be unwounded and short term vega has to be traded.

Overhedging/Underhedging

An option price is a function of parameters like volatility, spot, strike and barrier levels. Consider a deep ITM Autocallable, now if a trader has view that markets are going to fall, what he can do?

- Write off the DIP

- And when markets actually fall and trigger the DIP barrier, bring the DIP barrier to its original place.

-

Basic idea is to under hedge or not hedge in this case as we are long the DIP

Incase an autocallable is deep OTM and markets are expected to rally, bump the coupon. Basic idea is to overhedge. When the structure autocalls you make more money than average because: you had bought more shares at a lower price to hedge the digital and sold them at a higher price when the structure knocked out.

Could you please explain how does the digital work in this case? My email address is chengguiming@gmail.com

Thanks very very much and look forward to hearing from you.

Comment by Gloria — January 15, 2010 @ 5:37 pm |